Online Banking Help

Online Banking Login Instructions

1. Enter your User Name and check the First Time User checkbox. Note: At this time you do not have a password, please leave that field blank. Click on the Sign in to Online Banking button.

2. Next, you will select the delivery method in which you would like your Secure Access Code delivered to you. We recommend phone or text delivery, as they are the most prompt of the delivery methods. Click on the Submit button after making a selection.

3. You will then be taken to the Enter Access Code screen. As soon as you receive the Secure Access Code(either by phone, text or email address), enter it into the Secure Access Code field. Please note that your Secure Access Codecan only be used once, expires after 60 minutes and will be invalidated when subsequent codes are requested.

4. Next, you will be asked to accept the Online Banking disclaimer. Please read and click the I Accept button.

5. On the next screen you will be presented with your Online Profile to review and update if needed. Please ensure that all information is accurate before clicking the Submit button.

6. Next, you will create a new password. Password requirements are conveniently located on the right side of the screen.

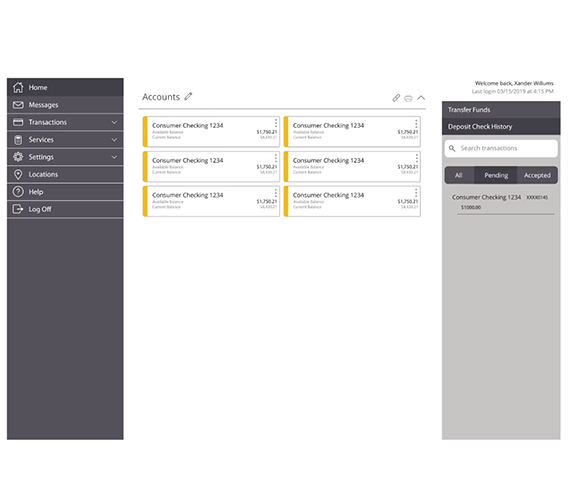

7. Once you have successfully logged into your Kitsap Bank Online Banking, you can view your accounts and transactions. Please note: On your next login to Online Banking, you will be required to register the browser on your computer for future use.

What browsers can I use for Online Banking?

- Microsoft Edge: Current and previous version

- Mozilla Firefox: Current and previous version

- Google Chrome: Current and previous version

- Apple Safari: Current and previous version

We also recommend that you enable JavaScript in your browser. JavaScript is required for certain Bill Pay Service features to function properly.

What are the system requirements for Online Banking?

- Standard PC or Mac® with at least 1 GHz processor 500 MB RAM or greater)

- Microsoft Windows 10 or Mac OS 10.10.

- Cable, DSL, or ISDN Internet connection. Dial-up connections are not supported.*

- An internet connection with a minimum of 1Mbps download speed.

- Supported browser for consumer and commercial users (see below)

- Security, anti-virus and spyware updates applied

- A valid email address and telephone number

* Note: Satellite cable connections often have difficulty supporting encrypted (https) applications which are encrypted for the safety of your financial information. Since Online Banking is https-encrypted for the safety of your financial information, some satellite cable connections may exhibit slow responses.

What is a Tracking ID?

The Tracking ID is a unique identifier for each transaction that you create in online banking and in Kitsap Bank’s Mobile App. It is a reliable way to reference a transaction. Tracking IDs appear in the transaction details on the Activity Center page. When you use secure messages to inquire about an account or a transaction, the message automatically includes the tracking ID.

Online and Mobile Banking Security

- View these short video tutorials to learn more about online and mobile security features. Learn how to set-up Touch ID, Establish Alerts, Send Messages Securely, and more! View Videos

Online and Mobile Banking Security for Businesses

- View these short video tutorials to learn more about online and mobile security features for businesses. View Videos

Transport Layer Security (TLS) Requirements

Beginning April 18th, 2018 TLS (Transport Layer Security) 1.0 security protocol will no longer be supported for Online Banking and Cash Management Services. You may need to upgrade your browser(s) to disable TLS 1.0 and use TLS 1.1 or higher. If it is determined your browser has not disabled TLS 1.0, you will not be able to access the Online Banking or Cash Management Services, including Bill Pay. Browsers that have TLS 1.0 enabled may get a warning that stronger security is required. Please upgrade your browser to use TLS 1.1 or higher.

You can verify if your browser already has TLS 1.0 disabled by copying and pasting this URL into your browser: https://tls1test.salesforce.com/s/.

If you have questions about logging in of using these services, please contact our Customer Service Center toll-free at 800.283.5537, option 7 (Monday - Friday, 8am - 5pm).

What is a Secure Access Code?

The Secure Access Code is system generated and will be sent to the delivery method you choose. In today's online environment, login ID/password access to your financial information is no longer considered sufficient to securely verify your identity.

Therefore, in addition to your login ID and password, our online verification requires us to deliver you a one-time piece of required information via something only you possess (for example, your email account or your telephone). Once you receive the additional piece of information (a Secure Access Code) and enter it into our system, you have the option to register your browser with a cookie for future use.

Please note: Secure Access Codes cannot be delivered via email to Cash Management clients.

Why do I need to register my device?

Once you have successfully logged in to our Online Banking system, during each subsequent login, the Online Banking system will check your computer for a cookie (a tiny bit of information) that shows that your device has been registered. If the cookie is present, the Online Banking system will allow you to access your account information by entering your User Name and Password (or Touch ID or 4 digit Passcode, if set up).

If the cookie is not present, the Online Banking system will prompt you to request a new Secure Access Code in order to gain access to your account information. Once the Secure Access Code is entered, you will have two choices for accessing your Online Banking. If you select, “Register Device”, your device will be registered and a cookie will be added to your browser. If you select “Do Not Register Device”, your device will not be registered and a cookie will not be added to your browser. In this case, each subsequent login will require you to enter a new Secure Access Code when accessing your accounts from this device until the device is registered.

These cookies are both device and browser specific. Once a cookie has been added to your browser, it will remain active for one year or until the cookie is removed or deleted. If you access the Online Banking system using a different browser or using a different device entirely, a new Secure Access Code will be required. This security feature provides an extra level of protection to you.

I need additional help with Online Banking. Where can I call?

Telephone support available Monday through Friday, 8 AM to 5 PM PST

360.874.1088 800.2TELLER (800.283.5537), Option 7